Friday, May 10, 2013

Hyperbole and a Half posted again, and everyone needs to read it because:

- If you are depressed, it will resonate with you like whoa.

- If you are not depressed, it will clarify some stereotypes about depression that need to be said. An explanation like this has been needed for a LONG time.

- If you know someone who is depressed, you’ll be better at interacting with them after reading this.

Thursday, May 9, 2013

Online Sales Taxes: A Good Idea Done Badly

Isn't this the perfect moment for a value-added tax?

Reuters

On Monday, by a comfortable 69-27 majority, the U.S. Senate passed a controversial bill that will require online retailers with annual sales of more than $1 million to collect state sales taxes. Said Republican Mike Enzi of Wyoming: "This bill is about fairness. It's about leveling the playing field between the brick-and-mortar and online companies, and it's about collecting a tax that's already due. It's not about raising taxes."Wait, isn't it? Leaving aside the anomaly in today's world of a Republican sponsoring a bill that raises revenue, the proposed law is entirely about raising taxes. The question, then, is whether these are taxes that ought to be raised, and if this is the way to raise them.

The short answers: Yes to the first, no to the second. This bill is precisely the wrong way to raise revenue from a growing stream of business. It applies a tax designed for physical entities to new commerce and does so in ways that will do little to help states or to reinvigorate small businesses that are hurting.

As is, much of the tax system is not fair. We are acutely aware of the labyrinthine quality of the U.S. tax code. The vagaries of state-by-state sales taxes only add to the complication. Five states don't even have a sales tax (Alaska, Delaware, Montana, New Hampshire and Oregon), and seven states have no income tax, including no tax on dividends and interest (Alaska, Florida, Nevada, South Dakota, Texas, Wyoming and Washington). If fairness is your litmus, as it is Enzi's, then it is rather unfair to live in New Jersey as opposed to, say, Florida, given the radically higher tax burden.

A Lotta Headache for a Little Revenue

That much of the code is currently unfair is hardly an argument against making one aspect of it fairer. But the online sales tax bill will place added burdens on those already paying more, whereas those living in sales-tax-free states will continue to feel none. For years, those of us who live in states that levy a sales tax have enjoyed the free pass that comes with shopping tax-free on Amazon, eBay, and any number of online sites. We get to sit at our computers at 1 in the morning and order those much needed gyroscope-equipped power drills without the nuisance of that extra 6 percent tacked on by state legislators whom we've never heard of, didn't vote for and aren't entirely convinced actually exist.

The bill was created because of angst from retailers and state legislators. Retailers have long cried foul, claiming that the ability of online sites to sell the same goods without sales tax provides unfair advantages that drive brick-and-mortar stores out of business. Many small businesses with storefronts that rely on local customers have actively lobbied for an online sales tax, asserting that unless that playing field is leveled, more small retailers will go out of business, eliminating jobs and harming local communities. Cash-strapped state governments have been even more adamant, arguing that they are losing more than $23 billion a year in foregone revenue because of the loophole, with negative consequences for teachers, police officers and all residents.

Even here, however, the problem isn't so simple. Some small business owners have warned that the burden of record keeping for their online sales by state will be immense. The bill has a proviso that each state develop software that will ease that burden, but there's hardly a guarantee that these systems will be harmonious, leaving a small business with $1 million in online sales to confront 44 different software widgets and a whole new IT budget. Given the competitive landscape of retail, the bill is likely to harm those who supposedly need it the most: small businesses.

While the bulk of commerce still takes place at brick-and-mortar stores, only e-commerce is seeing rapid growth. And while some of that is cannibalizing physical stores, e-commerce is creating new markets, which has been as much the savior of small, innovative businesses as a disruptor. Smart boutique owners know how to add an online component, which works in tandem with their physical store and often becomes an even larger entity.

Then there are state governments, many of which need all the cash they can get to cover pension plans that are seriously underfunded. The allure of "lost" online revenue is understandable, but states would be better served by encouraging online commerce, especially if they are determined to tax it. That is where the growth is. If you want vibrant communities, you have to support the virtual ones.

This or VAT?

Nonetheless, governments require revenue. Over the past years, there have been various calls for a value-added tax in the United States; the explosive growth of online commerce should renew that debate. The VAT is well suited to online commerce because it creates a chain of revenue that goes from vendors to wholesalers to final customers. Of course, a VAT would be inherently disruptive of state-sales taxes and would require radical changes at the state and national levels. We appear nowhere near that.

After sailing through the Senate, it appears that the bill's final passage in the House of Representatives is uncertain and perhaps unlikely. House Speaker John Boehner is in no hurry to bring the bill to a vote, and while we know that his views hardly determine the behavior of the Republican caucus, in this case it is certainly more in sync. There is predictable, if knee-jerk, opposition from those Republicans committed to no new taxes, and there is intense lobbying from powerful online players such as eBay to slow passage or further amend the bill.

This proposed bill is a bad implementation of a needed change. It's a reminder that what we can currently do politically is far short of optimal. In this case, it fails to even be acceptable. It raises a small amount of revenue and generates a large amount of friction. It does, however, highlight that not all areas of our economy are bleak and moribund. It's the very vibrancy of the e-commerce world, both independent of and connected to physical stores, that led to this legislation. Remember the thief who was asked why he robbed the bank and answered, "Because that's where the money is"? Well, that's why we have this new bill, because e-commerce is thriving. The bill may be a poor idea, but at least there's a sector of our economy that is doing so well

.

Wednesday, May 8, 2013

If You Graduated After 1976, You Are Getting Screwed By The Economy

This infographic shows the hard truth for anyone in their late 30s or younger: Everything has been more difficult for you, and it’s just getting worse.

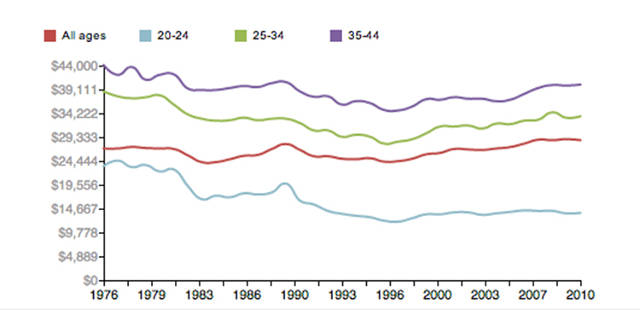

The 1970s have strangely become, in retrospect, a golden era, at least for economists. In large part that’s because of what happened ever since to the average American’s share of subsequent economic growth, as documented by a host of indicators. In the 1970s, median income and economic growth began to diverge, the income share of the top 10% started to steadily increase, and the United States generally became a more income unequal place.

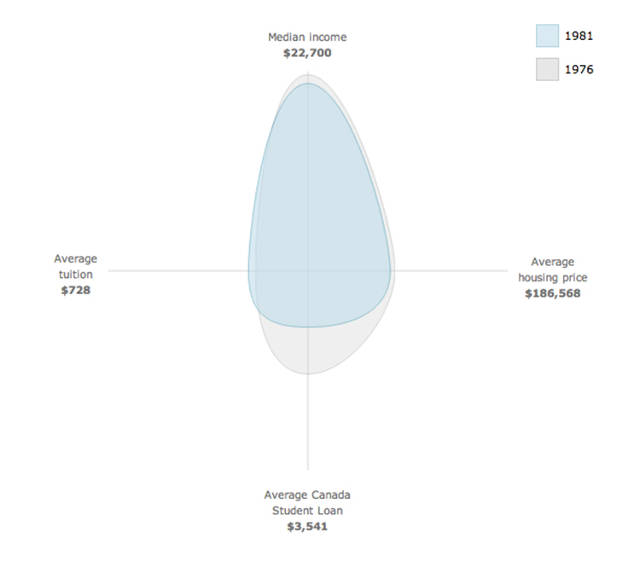

But that story isn’t as uniquely American as you might think. An interactive graphic from the Globe and Mail tracks a number of indicators for Canada to answer the question: Who had it worse? You, or the graduating class of 1976? If you graduated after 1976, the answer is, with very few caveats: You do.

The interactive graphic lets you track a few key indicators for a college-graduate-age Canadian: income, tuition, housing prices, and student loans. The results are sobering. Since 1976, average tuition has gone up nearly ninefold. Only student loans borrowed through the government are tracked, but even these are up more than 20%.

You have to go back to 1998 to find any indicator register as “better” than in 1976. And even that “better” approaches an exaggeration: an average housing price that, at $192,929 beats 1976 by $71 in 2010 dollars. That glimmer of affordability was followed by two decades of steady increases, to the point that now there is widespread concern over a possible housing bubble.

Perhaps the most alarming part of the picture, though, is in median income for 20- to 24-year-olds. In 2010 dollars, it fell like a rock in the recession of the early 1980s, from $22,700 in 1981 to $16,600 in 1983 and has remained essentially stagnant ever since.

As Rob Carrick writes in the accompanying column: “Prosperity has left young adults in the dust.”

“In a way, it was easier for young people in the past than it is now,” [Benjamin Tal, deputy chief economist at CIBC World Markets] said. “Basically, you’re running faster just to stay in the same place today.

12 Beautiful Photos Of Ridiculous Cell Phone Towers Disguised As Trees

The poor attempt by cell phone companies to disguise our mobile infrastructure as something natural is almost insulting. Photographer Dillon Marsh has documented some of the most egregious examples.

You’ve all seen them. One lone spectacle of arboreal majesty, towering above the treeline as you drive down the highway. It’s only when you get closer (though not too close, because the disguise is not so good) that you realize the impressive tree is nothing more than a cell phone tower with some rudimentary camouflage, meant to blend into its surroundings, but actually sticking out more for their poor attempt at blending in.

Dillon Marsh, a South African photographer, has created a photo series of the incongruous pieces of infrastructure. They’re from various places around that country: Durbanville, Paarl, Stellenbosch, Eerste River. Amazingly, it seems as though the problem is even worse there: the giant trees are made even more surreal by their total misplacement.

Marsh says he became "intrigued by [their] peculiar nature" after a tower went up near where he grew up. Then he started seeing more of them, and he became hooked:

"In 2009, when I came across another one, I decided to track down and photograph as many of them as I could find around Cape Town. This proved to be way more than I expected and in the end I decided to limit the series to 12 photos so that I could concentrate on new projects."

Wired has more on the history of towers-as-trees. Some of the first examples appeared in the U.S. Southwest in the early 1990s, made by a company called Larson Camouflage. Another photographer, Robert Voit, has snapped trees-masts in Portugal, Italy, and other places. His images are pretty interesting, too.

Generating Electricity With The Steps Of Exhausted Marathoners

This year’s Paris marathon also served as a demonstration of pavement that can create power just by being walked on. Runners at the finish line managed to create a lot of juice--but was it enough to make us rethink where we get our renewable energy?

Eight days before the Boston Marathon, a race took place in Paris with a very different surprise waiting for runners at the finish line: 176 rubber panels, converting the runners’ final steps into energy.

It was the largest installation yet of Pavegen, a creation of 27-year-old Laurence Kemball Cook. Pavegen is an electricity generating tile made from recycled car tires, and a creative, if arduous, way to generate power. “One step on a Pavegen generates up to 8 watts per second,” spokesperson Alex Johnson told us. By my calculations, that means if you walked in place on a Pavegen tile at a rate of one step per second, it would take you 40 minutes to charge your iPhone.

Still, with more than 50,000 runners those steps add up. Schneider Electric--who commissioned the project--held a contest on Facebook, and said if they generated over 7 kilowatt-hours of energy they would make a donation to Habitat for Humanity. “To generate 7 kwh would require up to 3,150,000 steps, depending on force of steps,” said Johnson.

As it turned out, all those runners generated more like two-thirds of that: 4.7 kilowatt-hours. That’s enough to power a Nissan Leaf to drive 15 miles, according to Johnson.

A power source that requires a marathon for a morning commute is unlikely to displace solar or wind as the renewable energy source of choice. The value seems more instructional, as shown in their choice of the Simon Langton Grammar School for Boys for their first permanent installation. “It’s a fantastic opportunity for the students to get visual representation of what they’re doing, the way that they can harness energy,” says Simon Langton headmaster Matthew Baxter in a promotional video. “It looks good.”

Tuesday, May 7, 2013

Monday, May 6, 2013

Subscribe to:

Comments (Atom)